What Is Subject To Sales Tax In Pennsylvania . Web the pennsylvania sales tax rate is 6 percent. Additionally, the state allows local jurisdictions to add additional. Printing or imprinting of tangible personal property of. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Web following is a list of taxable services in pennsylvania. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web pennsylvania’s sales and use tax rate is 6 percent. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: 1) have nexus with pennsylvania, and. Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. Municipal governments in pennsylvania are also.

from www.lao.ca.gov

Printing or imprinting of tangible personal property of. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. By law, a 1 percent local tax is added to purchases made in allegheny county, and. 1) have nexus with pennsylvania, and. Additionally, the state allows local jurisdictions to add additional. Web pennsylvania’s sales and use tax rate is 6 percent. Web the pennsylvania sales tax rate is 6 percent. Municipal governments in pennsylvania are also. Web following is a list of taxable services in pennsylvania. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must:

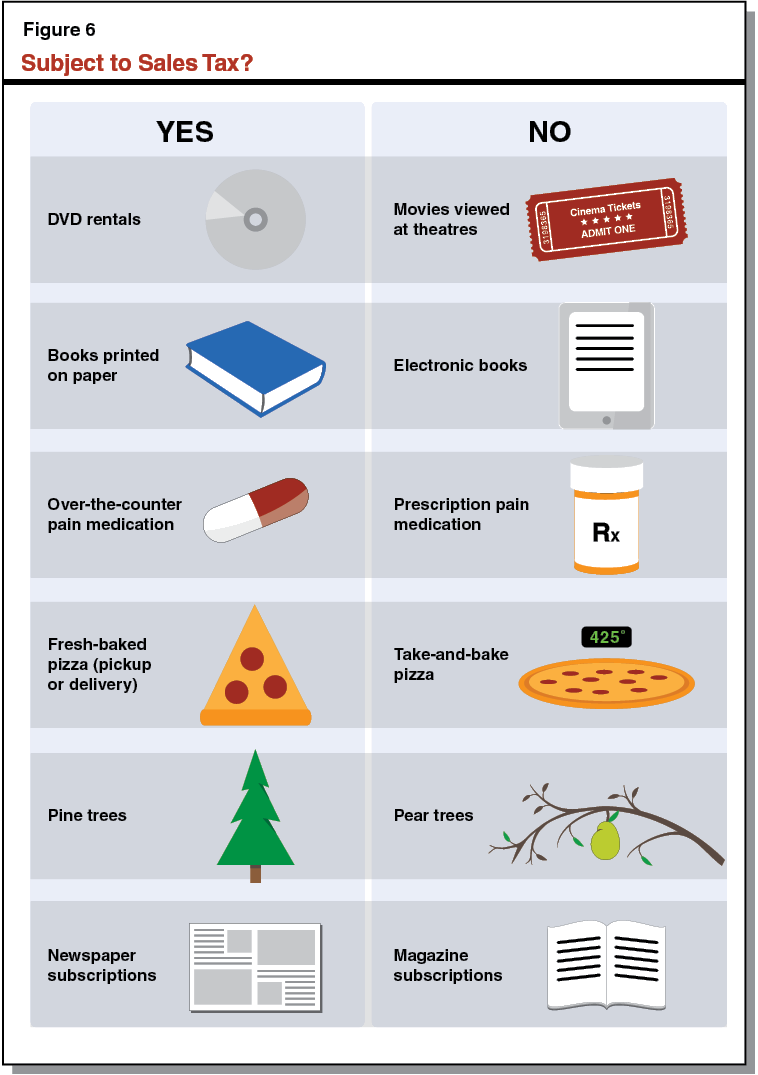

Understanding California’s Sales Tax

What Is Subject To Sales Tax In Pennsylvania Web the pennsylvania sales tax rate is 6 percent. Municipal governments in pennsylvania are also. Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Additionally, the state allows local jurisdictions to add additional. Web pennsylvania’s sales and use tax rate is 6 percent. Web following is a list of taxable services in pennsylvania. 1) have nexus with pennsylvania, and. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Printing or imprinting of tangible personal property of. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Web the pennsylvania sales tax rate is 6 percent.

From bevvyyangelle.pages.dev

California Sales Tax Rates 2024 By City Hatty Lesley What Is Subject To Sales Tax In Pennsylvania Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: By law, a 1 percent local tax is added to purchases made in allegheny county, and. Additionally, the state allows local jurisdictions to add additional. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances,. What Is Subject To Sales Tax In Pennsylvania.

From www.lorman.com

Update on Pennsylvania Sales and Use Tax Assessment Appeals and Refund What Is Subject To Sales Tax In Pennsylvania Web the pennsylvania sales tax rate is 6 percent. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Web pennsylvania’s sales and use tax rate is 6 percent. Municipal governments in pennsylvania are also. Web following is a list of taxable services in pennsylvania. Additionally, the state allows local. What Is Subject To Sales Tax In Pennsylvania.

From www.aaaanime.com

Click Here What Is Subject To Sales Tax In Pennsylvania Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. Web pennsylvania’s sales and use tax rate is 6 percent. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web following is a list of taxable services in pennsylvania. 1) have nexus with pennsylvania, and. Municipal. What Is Subject To Sales Tax In Pennsylvania.

From grantbbarrattxo.blob.core.windows.net

Pennsylvania Property Tax Sale What Is Subject To Sales Tax In Pennsylvania Printing or imprinting of tangible personal property of. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Municipal governments in pennsylvania are also. Web pennsylvania’s sales and use tax rate is. What Is Subject To Sales Tax In Pennsylvania.

From www.salestaxsolutions.us

Sales Tax Pennsylvania State of Pennsylvania Sales and Use Tax What Is Subject To Sales Tax In Pennsylvania Municipal governments in pennsylvania are also. Web following is a list of taxable services in pennsylvania. 1) have nexus with pennsylvania, and. Printing or imprinting of tangible personal property of. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Additionally, the state allows local jurisdictions to add additional. Web goods that. What Is Subject To Sales Tax In Pennsylvania.

From lanaqrobina.pages.dev

What Is The Pa State Tax Rate For 2024 Sandy Cornelia What Is Subject To Sales Tax In Pennsylvania Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Additionally, the state allows local jurisdictions to add additional. Web following is a list of taxable services in pennsylvania. Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. Web the pennsylvania sales. What Is Subject To Sales Tax In Pennsylvania.

From www.dochub.com

Pa resale certificate pdf Fill out & sign online DocHub What Is Subject To Sales Tax In Pennsylvania Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. 1) have nexus with pennsylvania, and. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Web following is a list of taxable services in pennsylvania. By law, a 1 percent local tax is added. What Is Subject To Sales Tax In Pennsylvania.

From grantbbarrattxo.blob.core.windows.net

Pennsylvania Property Tax Sale What Is Subject To Sales Tax In Pennsylvania Printing or imprinting of tangible personal property of. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Municipal governments in pennsylvania are also. Web following is a list of taxable services in pennsylvania. Additionally, the state allows local jurisdictions to add additional. Web like most states, to be subject. What Is Subject To Sales Tax In Pennsylvania.

From cs.thomsonreuters.com

Pennsylvania How to determine which local taxes should calculate What Is Subject To Sales Tax In Pennsylvania By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web following is a list of taxable services in pennsylvania. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Municipal governments in pennsylvania are also. Web the pennsylvania sales tax rate is 6. What Is Subject To Sales Tax In Pennsylvania.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Pa What Is Subject To Sales Tax In Pennsylvania Printing or imprinting of tangible personal property of. Web the pennsylvania sales tax rate is 6 percent. Municipal governments in pennsylvania are also. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Web. What Is Subject To Sales Tax In Pennsylvania.

From www.strashny.com

Pennsylvania Cuts Corporate Net Tax Rate Laura Strashny What Is Subject To Sales Tax In Pennsylvania Web following is a list of taxable services in pennsylvania. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Municipal governments in pennsylvania are also. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Web the pennsylvania sales tax rate. What Is Subject To Sales Tax In Pennsylvania.

From www.northwestregisteredagent.com

Pennsylvania Sales Tax License Northwest Registered Agent What Is Subject To Sales Tax In Pennsylvania Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Web the pennsylvania sales tax rate is 6 percent. Web following is a list of taxable services in pennsylvania. Printing or imprinting of tangible personal property of. 1) have nexus with pennsylvania, and. Web pennsylvania’s sales and use tax rate is 6. What Is Subject To Sales Tax In Pennsylvania.

From erinwhitehead.z13.web.core.windows.net

Printable Sales Tax Chart What Is Subject To Sales Tax In Pennsylvania Web following is a list of taxable services in pennsylvania. Additionally, the state allows local jurisdictions to add additional. Municipal governments in pennsylvania are also. Printing or imprinting of tangible personal property of. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Web like most states, to be subject. What Is Subject To Sales Tax In Pennsylvania.

From www.pinterest.com

Pennsylvania Sales Tax Guide for Businesses Tax guide, Sales tax, Tax What Is Subject To Sales Tax In Pennsylvania By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web pennsylvania’s sales and use tax rate is 6 percent. Web following is a list of taxable services in pennsylvania. Municipal governments in pennsylvania are also. 1) have nexus with pennsylvania, and. Printing or imprinting of tangible personal property of. Additionally, the state allows. What Is Subject To Sales Tax In Pennsylvania.

From www.formsbank.com

Form PaW3 Employer Quarterly Return Of Withholding Tax Pa What Is Subject To Sales Tax In Pennsylvania Web pennsylvania’s sales and use tax rate is 6 percent. Web following is a list of taxable services in pennsylvania. Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. Printing or imprinting of tangible personal property of. Web the pennsylvania sales tax rate is 6 percent. Web goods that are subject to. What Is Subject To Sales Tax In Pennsylvania.

From tutore.org

Pennsylvania Exemption Certificate Master of Documents What Is Subject To Sales Tax In Pennsylvania Web following is a list of taxable services in pennsylvania. Web like most states, to be subject to pennsylvania sales tax collection and its rules, your business must: Printing or imprinting of tangible personal property of. Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. Web goods that are subject to sales. What Is Subject To Sales Tax In Pennsylvania.

From www.icsl.edu.gr

Where'S My State Tax Refund Pennsylvania What Is Subject To Sales Tax In Pennsylvania Web pennsylvania has a statewide sales tax rate of 6%, which has been in place since 1953. Municipal governments in pennsylvania are also. Web goods that are subject to sales tax in pennsylvania include physical property, like furniture, home appliances, and motor vehicles. Printing or imprinting of tangible personal property of. Additionally, the state allows local jurisdictions to add additional.. What Is Subject To Sales Tax In Pennsylvania.

From www.formsbank.com

Form Pa1 As (I) Use Tax Return printable pdf download What Is Subject To Sales Tax In Pennsylvania Additionally, the state allows local jurisdictions to add additional. Web the pennsylvania sales tax rate is 6 percent. 1) have nexus with pennsylvania, and. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web pennsylvania’s sales and use tax rate is 6 percent. Web pennsylvania has a statewide sales tax rate of 6%,. What Is Subject To Sales Tax In Pennsylvania.